From Chief Investment Officer Tom Veale,

As we’ve seen now for the last few weeks, market risk as we measure it with the SignalPoint Market Risk Indicator (MRI) has been dropping. Again this week we see the various MRI components moving lower in their own ranges which brings the overall MRI downward. Data lag is still there, but it’s hard to see if the MRI would have also fallen further except for the MRI Oscillator giving us a feel.

When the odds of a horse winning the Kentucky Derby are 81+ to 1, is that greater or less than winning with Cryptocurrencies or New Issues? It seems the odds during the last 2+ years have favored the new issues even if the companies they represent are as of yet unproven. Is the Stock Market nothing but “off track betting” and Market Makers nothing but “Bookies?” Will we see “Rich Strike” win again or was it just a flash on the track? It would seem at first those of us who still review fundamentals are anachronistic but maybe we’re just not currently appreciated.

Continuing the buying triggered by our SignalPoint Process, last week saw additions to various income components as well as some individual company stocks and stock ETFs. We are monitoring these investments daily and continue to watch for opportunities to expand our positions. Only the Energy sector has been showing signs of triggering some opportunistic selling. Currently Value Line’s “Best Performers” list is showing 14 of 41 stocks being from the Energy sector alone.

Best regards,

Tom Veale

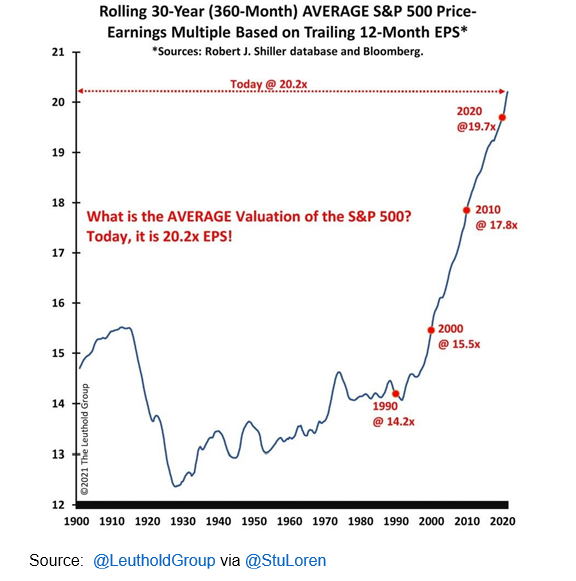

The MRI this week drops another two points to 34 with the MRI Oscillator showing minus 4, indicating declining market risk pressure. Three components are currently Neutral while Relative Valuation remains above its Neutral range. This graphic may help to explain this:

When short term interest rates and inflation were near zero these high P/Es were tolerable. However, with upward pressure on both those values, P/Es are beyond what can be considered sustainable. Elaine Garzarelli felt the sum of short term rates and broad P/E average was bearish if above 22 and bullish if below 18 with dead neutral being 20. As you can see, the P/E alone qualifies the market’s current condition acceptable only if interest rates stay below 1.80%/Yr. The ‘learned behavior’ of accepting extreme valuations relative to interest rates for the last two decades has need of modification.