From Chief Investment Officer Tom Veale,

“Last week’s trading had very little “feel good” included. At the week’s end all three major indexes were off the previous week’s close. Trading shows up as choppy with our Divergence Index rising from near bullish to mid-neutral. Both new Highs and Lows rose indicating higher levels of confusion by traders as the week progressed. Declining stocks outnumbered Advancing ones by more than 2:1.

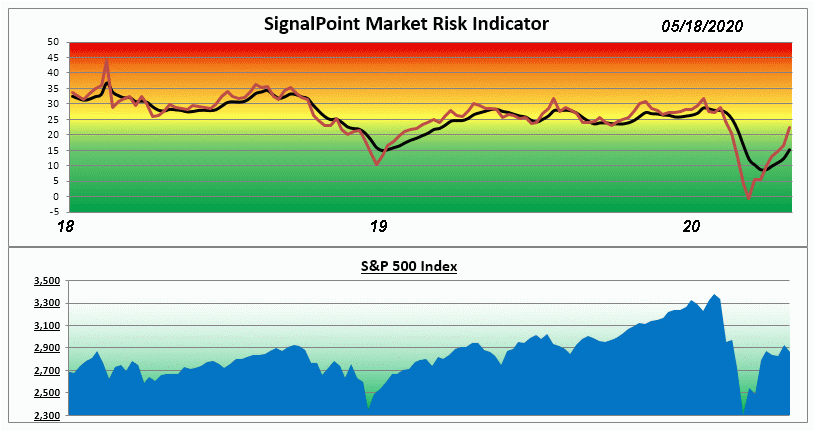

Increasing risk pressure is seen in our Market Risk Indicator as it rises 3 points to 15 this week. While still in its Bullish overall territory it shows how quickly risk is rising. The MRI Oscillator shows +11 indicating extremely strong rising risk pressure. Three of the four MRI components rose in risk over the week with only the Speculation Index remaining bullish. Even so, this is now the 9th week with the MRI in its bullish territory.”

”Economists are struggling to make sense of such unusual factors as “Stay at Home”, massive FED and government financial intervention and the effects of regional areas starting back toward more normal activities. It’s all happened so fast that data lag is an important component of what they are attempting to explain. Dust is still settling.

Of note this week is three gold/precious metals companies are on Value Line’s “Best Performers, latest 13 Weeks” list. It appears some traders are starting to be concerned about potential inflationary pressures as shiny metals rise in price to levels not seen since 2011.”

The Market Risk Indicator is an assessment tool that serves as a guide through all markets as to the prudent use of a liquid cash cushion. It helps determine an approximation of the amount of cash reserve relative to a diversified equity portfolio. (this is depicted by the graph above)

At times of high risk in the market, the MRI will suggest a higher level of cash reserve. At times of low market risk, the MRI will suggest a lower level of cash reserve. This investment process helps to measure and manage market risk.

Because of this, the fear associated with the uncertainty of the market can be replaced by the security of a sound investment strategy.