From Chief Investment Officer Tom Veale,

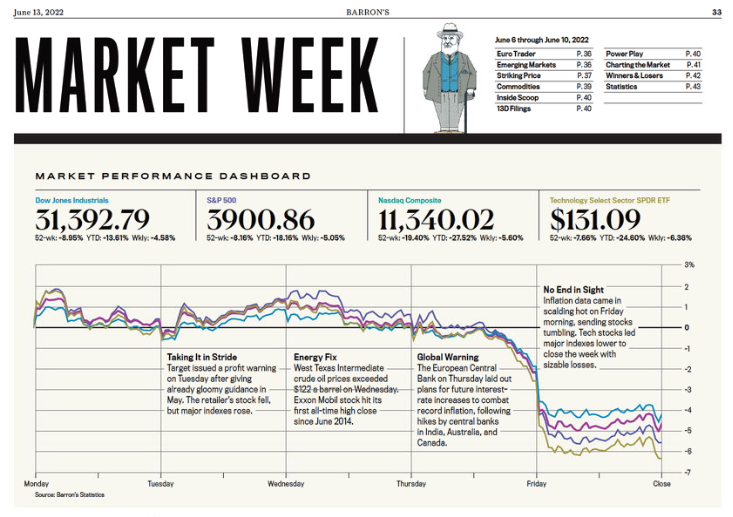

It wasn’t a great week and Friday wasn’t the best way to close things.

While June is putting some further downward pressure on the markets, our various strategies remain prepared to add to the positions should Buy targets be reached.

Here’s how the SignalPoint Market Risk Indicator looks as of Friday’s close:

Best regards,

Tom Veale

The MRI rose one point to 31 this week. The MRI Oscillator shows a +5 indicating rising risk pressure. All four MRI components rose in their own risk ranges but only one remains above its bearish threshold (Relative Valuation Index).