From Chief Investment Officer Tom Veale,

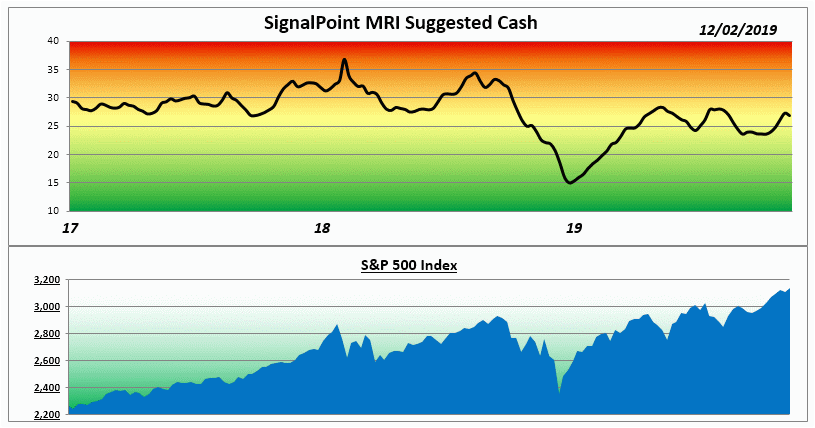

“The Market Risk Indicator (MRI) still suggests 27% cash for diversified stock portfolios. The MRI Oscillator has dropped back to +2 indicating upward risk pressure has relaxed a bit.”

“The MRI components show three rising and one falling in risk profile. The troublesome Divergence Index fell back to the middle of the Neutral range and enough to offset mild rises in the other components. Overall, the MRI is still neutral and only one point above its median value. This seems to be contrary to headlines suggesting the bull market is tiring. It is a long time until the next presidential election is history so it probably won’t be a smooth ride. But compared to mid-2018 risk seems mild.”

The Market Risk Indicator is an assessment tool that serves as a guide through all markets as to the prudent use of a liquid cash cushion. It helps determine an approximation of the amount of cash reserve relative to a diversified equity portfolio. (this is depicted by the graph above)

At times of high risk in the market, the MRI will suggest a higher level of cash reserve. At times of low market risk, the MRI will suggest a lower level of cash reserve. This investment process helps to measure and manage market risk.

Because of this, the fear associated with the uncertainty of the market can be replaced by the security of a sound investment strategy.