From Chief Investment Officer Tom Veale,

The activity last week represents some consolidation of most recent gains from the summer lows. It wasn’t enough to offset some of the other market internals as of yet. Value Line’s P/E rose to 16.6 (from 16.2) this last week which is a driving force for the SignalPoint Market Risk Indicator (MRI). Even with the flat CPI (but high) and leveling 13 Week Treasury Coupon rate it pushed our Relative Valuation Index upward. Overall, the market risk rose a bit more.

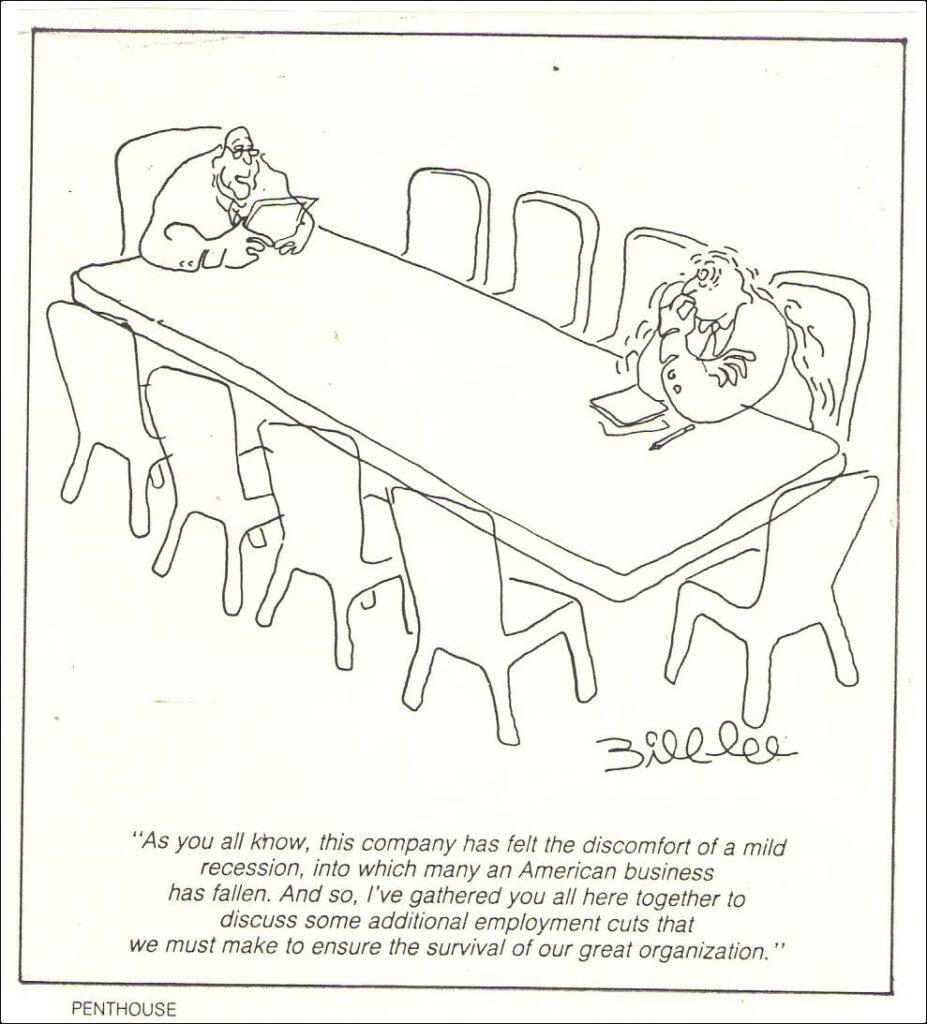

We were able to capture some profits and salt away some cash in a few positions last week with the market gains. Cash reserve levels remain adequate for current market conditions. Talk of a recession seems to exceed the current economic news. There is a time to start to worry as this graphic suggests:

Tom Veale

The MRI comes in at 31, up two points from the previous week. The MRI Oscillator is still at +8 indicating continued upward risk pressure. Only Relative Valuation is currently bearish while the other three components of the MRI remain neutral.