From Chief Investment Officer Tom Veale,

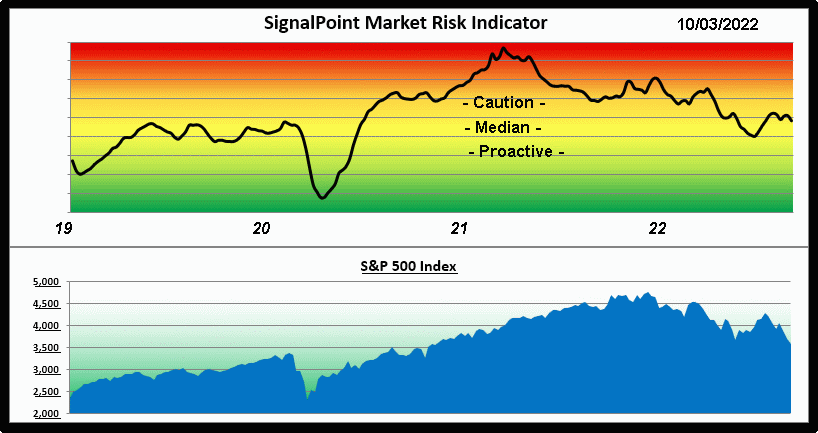

“The financial press is all a-buzz with talk of people “getting liquid” in their investment portfolios. SignalPoint’s contrary policy has it working to absorb more share inventory as prices decline. Across nearly all classes of assets there have been regular buy signals being triggered. Our Market Risk Indicator has been steady for several weeks now keeping pace with the market’s bipolar actions.

Three components of the MRI were down this week with one showing a full standard deviation below its median value. The Speculation Index is a good judge of how investors are reacting to the markets. It dropped to a healthy level with last week’s trading. It would appear the tide has flown outward carrying speculative dollars with it.

While the 10 Year Treasury Coupon Rate remains stuck at 2.75%/Yr, the market is currently pricing these bonds at a discount giving them an effective yield of over 3.8%/yr. The short duration end of the yield curve is well above 3%/yr at the present time.

Cash held in reserve for purchasing shares is currently at the lowest percentage level since the Covid 19 market swoon. We continue to work to deploy reserves as discounts are achieved that meet our buying targets.

Best regards,

Tom Veale

This week the MRI comes in at 29, down a point from a week ago. The MRI Oscillator comes in at minus 6 showing strong downward pressure on market risk. Of note is the Relative Valuation Index is now lower than it’s been in a long time an on the threshold of finally dropping to its neutral territory. The Speculation Index is bullish showing a dramatic shift of market participants’ portfolios toward cash. Our Divergence Index is in the lower half of its historic range and neutral and IPO activity remains benign right now.

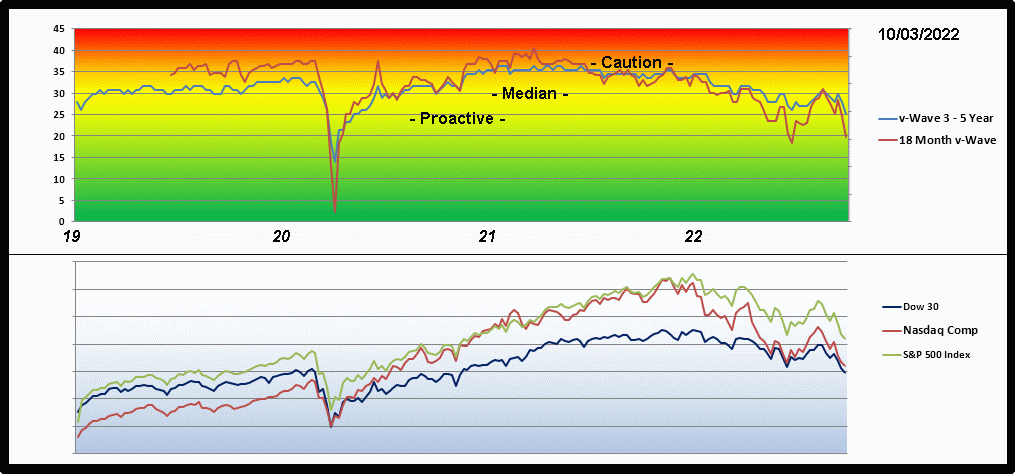

Another market risk indicator I use is called the v-Wave. I use it to compare to our MRI. It’s based in Value Line’s “Appreciation Potential” values given each week. Here’s how it looks right now:”